All Categories

Featured

Table of Contents

Adolescent insurance coverage may be sold with a payor benefit rider, which offers for forgoing future costs on the youngster's plan in case of the death of the individual that pays the costs. term life insurance vs ad&d. Elderly life insurance coverage, sometimes described as rated survivor benefit plans, gives qualified older candidates with marginal entire life protection without a medical exam

The acceptable problem ages for this kind of coverage variety from ages 50 75. The maximum issue quantity of protection is $25,000. These plans are generally extra costly than a fully underwritten plan if the person certifies as a standard threat. This sort of insurance coverage is for a small face amount, normally purchased to pay the funeral expenditures of the guaranteed.

In case you die in the next 30 years, they can use the death benefit to settle the home loan and cover various other prices. Last expense or burial life insurance coverage makes sense if: You're in between 50 and 85 years oldYou desire an economical policyYou only desire your funeral and various other final expenditures covered You're 55 and preparing for your retirement years.

One year of term life insurance policy insurance coverage makes sense if: You intend to experiment with life insuranceYou just desire short-term coverageYou remain in between work and briefly without employer-provided insurance coverage You are 25, have a kid, and aren't sure where to begin with life insurance policy. You choose to obtain one year of extremely budget friendly protection so you can make a decision if you desire to devote to a longer-term plan.

The Federal Government developed the Federal Employees' Team Life Insurance (FEGLI) Program on August 29, 1954. It is the biggest team life insurance program in the globe, covering over 4 million Federal staff members and retired people, in addition to several of their relative. A lot of employees are eligible for FEGLI insurance coverage.

Level Premium Term Life Insurance Policies Do What

It does not build up any type of cash money worth or paid-up value. It includes Standard life insurance policy coverage and 3 choices. If you are a brand-new Federal employee, you are automatically covered by Fundamental life insurance and your pay-roll office deducts costs from your income unless you waive the protection.

You have to have Fundamental insurance in order to elect any one of the choices. Unlike Fundamental, enrollment in Optional insurance coverage is manual-- you need to do something about it to elect the options. The cost of Standard insurance coverage is shared between you and the Federal government. You pay 2/3 of the overall expense and the Federal government pays 1/3.

You pay the full cost of Optional insurance coverage, and the price depends on your age. The Workplace of Federal Employees' Group Life Insurance Policy (OFEGLI), which is an exclusive entity that has an agreement with the Federal Government, processes and pays insurance claims under the FEGLI Program. The FEGLI Calculator permits you to identify the face value of numerous combinations of FEGLI coverage; determine premiums for the various mixes of insurance coverage; see how picking various Options can change the amount of life insurance policy and the premium withholdings; and see just how the life insurance policy lugged right into retirement will change with time.

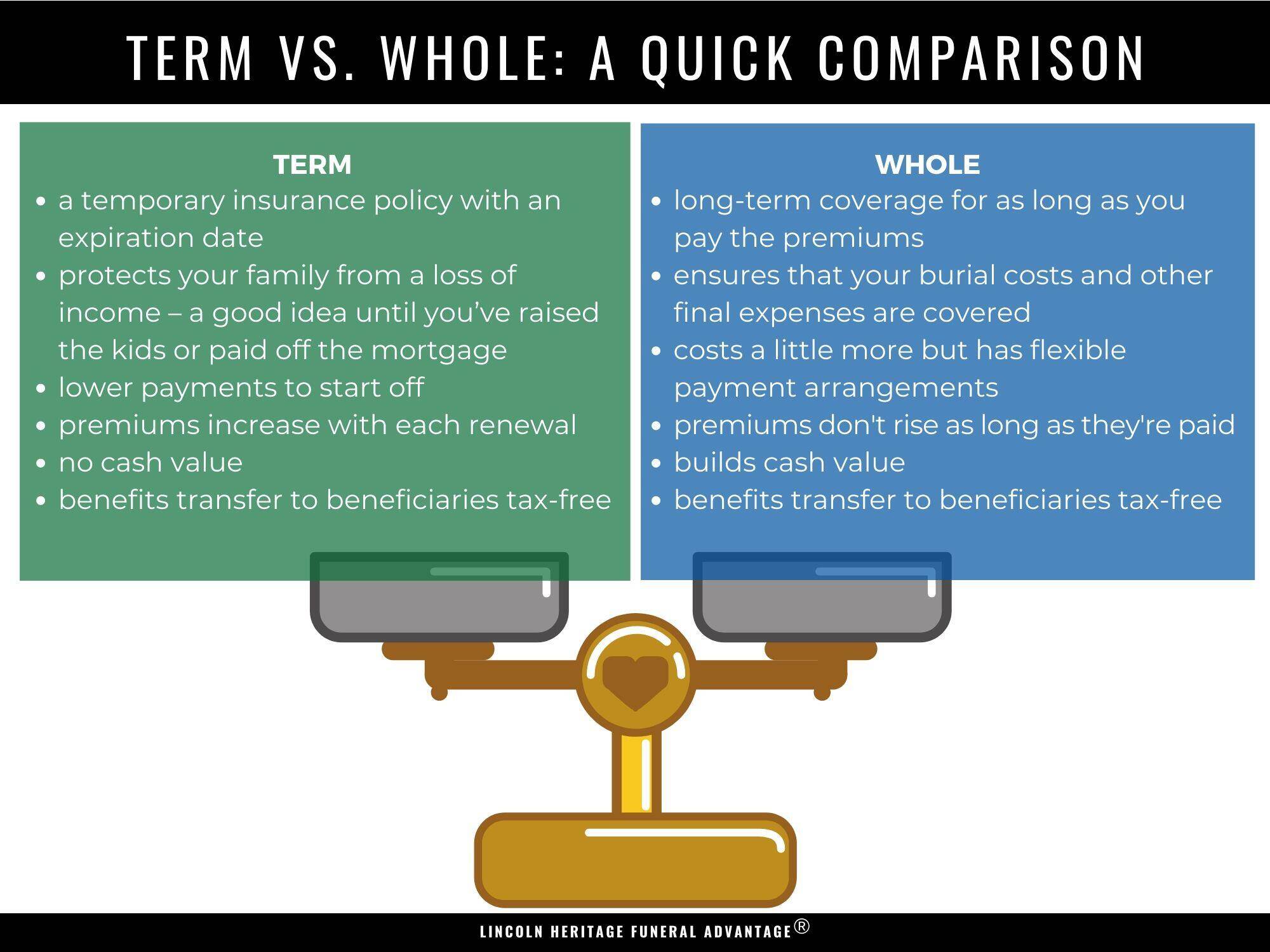

Term life insurance policy is a kind of life insurance policy that provides insurance coverage for a specific period, or term, selected by the policyholder. It's generally one of the most simple and affordable life insurance policy option by covering you for a set "term" (life insurance coverage terms are normally 10 to three decades). If you die during the term duration, your recipients receive a cash money repayment, called a death benefit.

Term life insurance policy is a straightforward and economical service for individuals seeking inexpensive defense during particular durations of their lives. It's crucial for individuals to meticulously consider their economic goals and requires when picking the period and amount of insurance coverage that finest suits their scenarios. That stated, there are a few factors that several individuals pick to get a term life plan.

This makes it an appealing choice for individuals who want considerable coverage at a reduced expense, especially throughout times of higher monetary responsibility. The other vital advantage is that premiums for term life insurance coverage plans are taken care of for the period of the term. This suggests that the insurance holder pays the exact same premium quantity yearly, supplying predictability for budgeting objectives.

A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called

2 Cost of insurance coverage prices are determined utilizing approaches that vary by firm. It's essential to look at all variables when examining the general competition of prices and the worth of life insurance policy protection.

Like many team insurance policy plans, insurance policy plans provided by MetLife have particular exemptions, exceptions, waiting durations, reductions, constraints and terms for maintaining them in force. Please contact your advantages manager or MetLife for expenses and complete information - what does level term mean in life insurance.

Our term life options include 10, 15, 20, 25, 30, 35, and 40-year plans. The most prominent type is level term, indicating your payment (costs) and payout (survivor benefit) stays level, or the exact same, till the end of the term period. This is one of the most uncomplicated of life insurance options and calls for extremely little maintenance for policy proprietors.

For example, you could give 50% to your spouse and divided the rest among your adult kids, a moms and dad, a friend, or even a charity. * In some instances the fatality advantage may not be tax-free, learn when life insurance policy is taxable.

Term life insurance policy provides coverage for a details time period, or "term" of years. If the guaranteed individual dies within the "term" of the policy and the plan is still effective (active), then the fatality benefit is paid to the beneficiary. 10 year renewable term life insurance. This kind of insurance coverage commonly allows customers to at first buy more insurance coverage for less cash (premium) than other sort of life insurance policy

Life insurance policy acts as a substitute for income. The possible risk of shedding that making power incomes you'll require to money your household's greatest goals like acquiring a home, paying for your youngsters' education, lowering financial debt, saving for retirement, etc.

Term Life And Ad&d Insurance

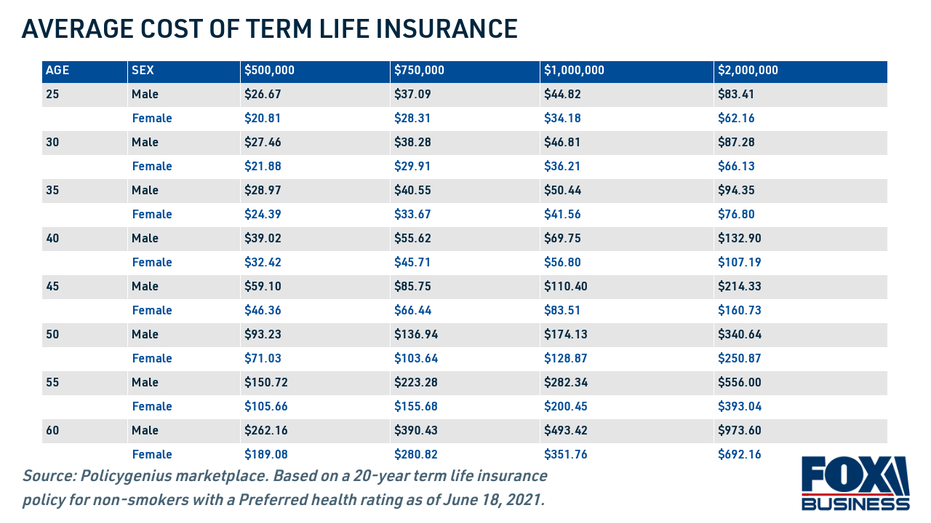

Term life is the most basic kind of life insurance policy. It supplies a pure death advantage. The policy will certainly cover the guaranteed for a specific amount of time (the "term"), such as 10 or 20 years, or till a specified age. If you buy term life insurance at a more youthful age, you can usually acquire more at a reduced price.

Term insurance policy is preferably fit to cover details requirements that might reduce or vanish in time Complying with are 2 common arrangements of term insurance policies you might wish to consider during the acquisition of a term life insurance policy. allows the insured to restore the plan without needing to confirm insurability.

Before they offer you a policy, the supplier needs to examine just how much of a threat you are to insure. This is called the "underwriting" procedure. They'll generally ask for a medical exam to assess your wellness and would like to know more about your occupation, lifestyle, and other things. Certain pastimes like diving are deemed risky to your health, and that may increase prices.

Term Life Insurance Exclusions

The expenses connected with term life insurance policy premiums can differ based upon these aspects - 15 year level term life insurance. You require to choose a term size: Among the most significant questions to ask on your own is, "The length of time do I require protection for?" If you have kids, a prominent general rule is to choose a term long sufficient to see them out of the residence and with college

1Name your beneficiaries: That obtains the advantage when you pass away? You might select to leave some or all of your benefits to a trust fund, a charitable company, or also a buddy.

Take Into Consideration Utilizing the penny formula: DIME means Financial obligation, Income, Mortgage, and Education and learning. Overall your financial obligations, home mortgage, and university costs, plus your salary for the number of years your family requires defense (e.g., until the youngsters run out your house), which's your coverage requirement. Some financial experts calculate the quantity you need making use of the Human Life Value approach, which is your life time earnings potential what you're gaining now, and what you anticipate to earn in the future.

One way to do that is to try to find business with strong Financial stamina ratings. 8A firm that underwrites its own policies: Some business can offer plans from one more insurance firm, and this can add an added layer if you desire to change your plan or in the future when your household requires a payout.

Some companies provide this on a year-to-year basis and while you can anticipate your rates to increase significantly, it may deserve it for your survivors. An additional way to contrast insurance provider is by taking a look at on-line client testimonials. While these aren't likely to inform you much concerning a company's monetary security, it can inform you exactly how very easy they are to collaborate with, and whether insurance claims servicing is a trouble.

How Is Increasing Term Life Insurance Normally Sold

When you're younger, term life insurance policy can be a simple method to secure your enjoyed ones. As life changes your economic concerns can also, so you may desire to have whole life insurance for its life time protection and added benefits that you can use while you're living. That's where a term conversion comes in.

Authorization is ensured no matter your health and wellness. The premiums will not enhance once they're set, however they will rise with age, so it's a great idea to lock them in early. Locate out even more concerning exactly how a term conversion functions.

1Term life insurance policy supplies momentary protection for an important period of time and is generally cheaper than permanent life insurance. 2Term conversion standards and limitations, such as timing, may use; as an example, there might be a ten-year conversion benefit for some items and a five-year conversion advantage for others.

3Rider Insured's Paid-Up Insurance coverage Purchase Choice in New York. There is a price to exercise this biker. Not all participating policy proprietors are eligible for rewards.

Latest Posts

International Term Life Insurance

Best Final Expense Insurance

Family Funeral Policy